First, let's break down exactly what goodwill means. When business owners say “goodwill” they usually mean economic goodwill and not accounting goodwill, which is a plug number on a balance sheet.

Economic goodwill refers to the the fair market value of a business that is over and above the value of its tangible assets and its identifiable intangible assets. IMPORTANT: NOT all businesses have goodwill. Only those businesses that can generate sufficient cash flow such that the present value of the cash flow exceeds the value of their net tangible assets and identifiable intangible assets have goodwill.

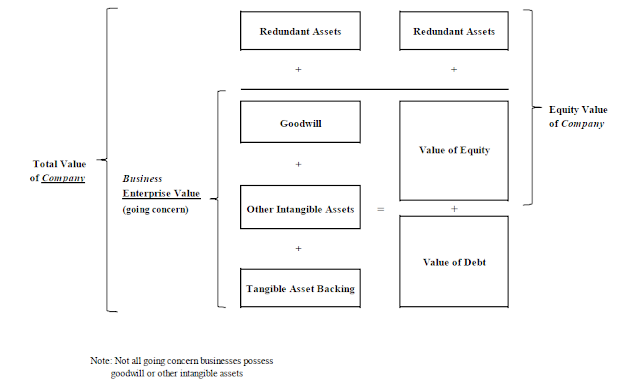

See the chart below for an illustration:

Keystone Valuations Blog - Steve Skrlac, MBA, CFA, CBV

Keystone Business Valuations is located in Burlington, Ontario and we provide professional business valuation & litigation support services such as business valuations for corporate reorganizations, tax, estate, divorce, disputes, oppression. We can also assist with quantifying economic losses. Serving Toronto, the GTA, Oakville, Burlington, Hamilton, Niagara, the KW region and across southern Ontario. Please visit us at www.keystonebv.ca or call us at 905-592-1525.

Wednesday 29 June 2016

Business Goodwill - What's It Worth?

Labels:

business valuation,

goodwill

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Divorce and the Division of Property - How to Equalize Assets

In Ontario, when a married couple divorces and assets need to be divided, there is generally an equalization payment that is made from a payor spouse to a payee spouse in order to equalize the increase in the spouses' net family property.

The increase in net family property is essentially the net property (assets less liabilities) each spouse owned at the date of separation, less the net property they owned at the date of marriage.

Example – if John and Mary each had $0 (or very close to $0) in property when they married and then at the date of separation John owned $1,500,000 in net property and Mary owned $500,000 in net property, then John would be required to make $500,000 equalization payment to Mary. After the $500,000 payment they would each have $1,000,000 in net property (equal).

It is important to note that if John owned a specific asset that Mary could not demand to be compensated with that asset on demand (example – if John owned an investment property in his name, Mary could not demand that John sign it over). What Mary would be entitled to receive is an equalization payment that equalizes the value of net family property as at the separation date.

The increase in net family property is essentially the net property (assets less liabilities) each spouse owned at the date of separation, less the net property they owned at the date of marriage.

Example – if John and Mary each had $0 (or very close to $0) in property when they married and then at the date of separation John owned $1,500,000 in net property and Mary owned $500,000 in net property, then John would be required to make $500,000 equalization payment to Mary. After the $500,000 payment they would each have $1,000,000 in net property (equal).

It is important to note that if John owned a specific asset that Mary could not demand to be compensated with that asset on demand (example – if John owned an investment property in his name, Mary could not demand that John sign it over). What Mary would be entitled to receive is an equalization payment that equalizes the value of net family property as at the separation date.

Labels:

divorce

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Top 10 Finance and Business Valuation Terms for Newbies

There is a lot of jargon that is thrown around in the world of finance and business valuation. This blog post attempts to lift the veil on some of the more commonly used finance & business valuation terms. Although there are many, many more terms that could be included on this list, these listed below are but a sample....

1. EBITDA – it stands for Earnings Before Interest, Taxes, Depreciation and Amortization. To calculate the EBITDA of a business you would take the net income of the business and add back the interest expense, income taxes, depreciation & amortization. EBITDA is an “unlevered” measure of profit – it is a profit measure before interest expense is deducted. It is intended to be a proxy for pre-tax cash flow but it does have some deficiencies such as not accounting for capital expenditures, changes in net working capital or differing tax rates.

2. Enterprise Value – in business valuation, Enterprise Value (EV) refers to the total value of a company, its debt and its equity combined. The theory is that EV is a measure of a company's total worth without the 'noise' associated with its capital structure. Using a house as an analogy... if your home was appraised to be worth $1 million and you had a $600,000 mortgage on it then the 'EV' of your house would be $1 million and the equity value of the home would be $400,000 ($1 million less $600,000). To calculate the equity value of a business you would subtract business debt from its EV.

A commonly used business valuation ratio is the Enterprise Value / EBITDA ratio. Example - if a business is valued at $400,000 Enterprise Value and has an EBITDA of $100,000 then the EV/EBITDA ratio would be 4x. This ratio could then be compared to industry peers.

1. EBITDA – it stands for Earnings Before Interest, Taxes, Depreciation and Amortization. To calculate the EBITDA of a business you would take the net income of the business and add back the interest expense, income taxes, depreciation & amortization. EBITDA is an “unlevered” measure of profit – it is a profit measure before interest expense is deducted. It is intended to be a proxy for pre-tax cash flow but it does have some deficiencies such as not accounting for capital expenditures, changes in net working capital or differing tax rates.

2. Enterprise Value – in business valuation, Enterprise Value (EV) refers to the total value of a company, its debt and its equity combined. The theory is that EV is a measure of a company's total worth without the 'noise' associated with its capital structure. Using a house as an analogy... if your home was appraised to be worth $1 million and you had a $600,000 mortgage on it then the 'EV' of your house would be $1 million and the equity value of the home would be $400,000 ($1 million less $600,000). To calculate the equity value of a business you would subtract business debt from its EV.

A commonly used business valuation ratio is the Enterprise Value / EBITDA ratio. Example - if a business is valued at $400,000 Enterprise Value and has an EBITDA of $100,000 then the EV/EBITDA ratio would be 4x. This ratio could then be compared to industry peers.

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Business Valuation - K.I.S.S.

There is a misconception that many people have that the more quantitative and complex a business valuation model, the better the business valuation final conclusion will be. The reality is usually quite different, especially when analysis-paralysis sets in. Sometimes the K.I.S.S. principle is a good one to remember.

In reality, when an arm's length buyer and seller negotiate the purchase & sale of a business they usually do not go to great pains to calculate things like foregone tax shield, unlevered betas, equity risk premiums, size premiums, and so on. A buyer and seller in the heat of a negotiation will usually focus on things like:

These are the truly important issues to get right.

In reality, when an arm's length buyer and seller negotiate the purchase & sale of a business they usually do not go to great pains to calculate things like foregone tax shield, unlevered betas, equity risk premiums, size premiums, and so on. A buyer and seller in the heat of a negotiation will usually focus on things like:

- How sustainable is the cash flow of the business?\

- How risky is the business's source of earnings?

- How can the buyer transition the business to himself?

- Can they grow the business?

These are the truly important issues to get right.

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Friday 20 May 2016

The Income Tax Act - When is a Valuation Required?

WARNING: Dry blog post ahead....

Unless you're an accountant, tax specialist or a business valuator, you should probably stop reading now ;)

The Income Tax Act of Canada requires value to be determined for many different reasons. The most common reason that value needs to be determined for income tax reasons is for a corporate reorganization (more on that later).

First, below is a laundry list of most instances when the Income Tax Act would require value to be determined. Some are well known, others less so:

- Employee stock options

- Debts of shareholders and certain persons connected with shareholders (section 15)

- Capital gains & losses

- Purchase price allocation

Unless you're an accountant, tax specialist or a business valuator, you should probably stop reading now ;)

The Income Tax Act of Canada requires value to be determined for many different reasons. The most common reason that value needs to be determined for income tax reasons is for a corporate reorganization (more on that later).

First, below is a laundry list of most instances when the Income Tax Act would require value to be determined. Some are well known, others less so:

- Employee stock options

- Debts of shareholders and certain persons connected with shareholders (section 15)

- Capital gains & losses

- Purchase price allocation

Labels:

corporate reorganization,

income tax

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Equity Value vs. Enterprise Value vs. Company Value... What's the Difference??

There seems to be some confusion some people have regarding the differences between total company value, equity value and enterprise value. This blog post will attempt to clarify these differences.

The biggest challenge some people have is differentiating between business enterprise value and total company value. Really simple example... imagine a barbershop business that made $50,000 per year in profit and was valued at $100,000 (not a real valuation but bear with me). Imagine now that the barbershop business was owned by an Ontario corporation. Now let's pretend that this Ontario Corporation also had $300,000 in its bank account. This cash is not used or needed by the barbershop business - it is a redundant asset. The value of the barbershop business is still only $100,000; however, the total value of the Ontario corporation would be $400,000 ($100,000 for the barbershop business value + $300,000 in redundant cash it has in its account).

Looking at the Graphic below, it illustrates the components of value that are included in Total Company Value, the business Enterprise Value and the Equity Value of a company.

Graphic:

I will attempt to explain, at a high level, the various components of value in the graphic above.

The biggest challenge some people have is differentiating between business enterprise value and total company value. Really simple example... imagine a barbershop business that made $50,000 per year in profit and was valued at $100,000 (not a real valuation but bear with me). Imagine now that the barbershop business was owned by an Ontario corporation. Now let's pretend that this Ontario Corporation also had $300,000 in its bank account. This cash is not used or needed by the barbershop business - it is a redundant asset. The value of the barbershop business is still only $100,000; however, the total value of the Ontario corporation would be $400,000 ($100,000 for the barbershop business value + $300,000 in redundant cash it has in its account).

Looking at the Graphic below, it illustrates the components of value that are included in Total Company Value, the business Enterprise Value and the Equity Value of a company.

Graphic:

I will attempt to explain, at a high level, the various components of value in the graphic above.

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Tip to Valuing a Business - Get the Story Right!

One of the biggest misconceptions out there is that the process of valuing a business is really just a hardcore quantitative exercise that consists of endless excel spreadsheets with complex financial models. Sure, business valuation does have a quantitative slant to it and, yes, there are excel spreadsheets involved. However, the more important point to grasp is that at its heart, a business valuation is all about the future of a business, not its past. And... because the value of a business is about its future then that, therefore, requires a really strong grasp of the 'story' behind the business which is then translated in a quantitative analysis. Too many people, including some professionals, tend to put the cart before the horse and simply jump right into their financial modelling without trying to understand first the story behind the business that should be driving the numbers, not the other way around.

You need to know the story behind the numbers

Buyers of a business care about the future of the business. They care about the future cashflow that the business is expected to generate and they care about the riskiness associated with the future cashflow. As a business valuator, I look to the past results of the business only to the extent that they may help me to understand what the future of the business might look like.

You need to know the story behind the numbers

Buyers of a business care about the future of the business. They care about the future cashflow that the business is expected to generate and they care about the riskiness associated with the future cashflow. As a business valuator, I look to the past results of the business only to the extent that they may help me to understand what the future of the business might look like.

Labels:

business valuation

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Please contact me at steve@keystonebv.ca or call me at 905-592-1525 to discuss your business valuation or litigation support needs. www.keystonebv.ca

Subscribe to:

Posts (Atom)